To sign up for our daily email newsletter, CLICK HERE

E-Commerce fraud detection is becoming even a bigger challenge while the industry is experiencing the rise. Learn about the best E-Commerce and affiliate fraud prevention tools to secure your payments!

Introduction to E-commerce fraud prevention tools

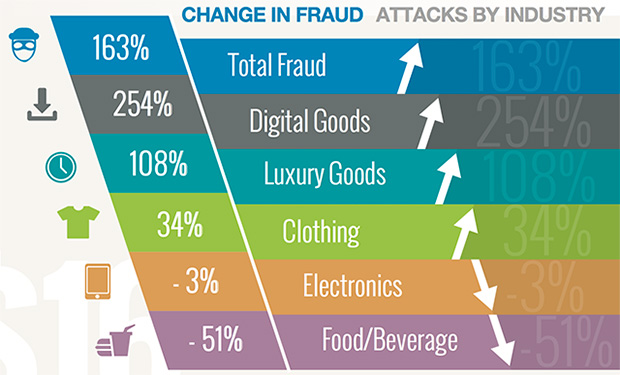

Today the E-Commerce industry is on the rise. With the unfortunate situation with the COVID-19 pandemic, the demand for this industry is even higher. Fraudsters are dramatically increasing the number of their attempts to damage the E-Commerce industry as shown in this study. How to prevent and stop it? This is the main point of this article!

What is fraud in e-commerce?

The main difference in E-Commerce fraud compared to any other fraudulent activity is that criminals do not even need a physical card for their actions. For a false transaction to occur between a marketplace and a customer bank account only card information is required. There are multiple ways to steal customer’s information, that’s why online payment fraud detection deserves to be discussed separately of any other fraud prevention and detection activity.

How E-commerce fraud can be detected and prevented?

The good news is that technology is evolving fast to catch up with the latest criminal activity methods. Credit card fraud detection using machine learning, for instance, is becoming more popular in E-Commerce fraud prevention tools. If you are aware of the latest security tools and implement them in your business in the time this should be an answer to your internet security question. Let’s dive deep with more details!

What are the risks and frauds that are happening online?

Before moving to E-Commerce fraud prevention best practices and understanding the most efficient fraud detection and protection solutions in E-Commerce we should mention the most common threats to which online businesses are exposed to:

Chargeback Fraud

These are just a few examples of chargeback fraud, and it can sometimes be hard to differentiate between fraud and a legitimate claim, as if you look at Mastercard reason codes you will see that there is quite an extensive list of reasons for a chargeback to be initiated. It’s even harder to distinguish real criminal activity from “friendly fraud” – mistakes by the real customer. To minimize such accidents it is important to make every charge and move in the purchasing process clear and understandable for the customer.

The following three scenarios can be considered a part of this type of fraud:

• A customer buys a massive order and cancels the order right after the shipment, receiving goods without any pay

• A criminal, acting as a customer, can get in touch with the banking institution and claim his identity was stolen, by this canceling the transaction

• Finally, a scammer can say that he never received the delivery and ask for another delivery. For the business, it takes time and effort to properly investigate each case, so it will lose money anyway

It’s even harder to distinguish real criminal activity from “friendly fraud” – mistakes by the real customer. To minimize such accidents it is important to make every charge and move in the purchasing process clear and understandable for the customer.

Pagejacking

The big threat to online retailers worldwide! There are some examples of top websites being mimicked by fraudulent web pages and even getting a significant part of traffic. Pajejacking can heavily damage the reputation of your brand and the trust of your customers.

Email Account Phishing

In the context of an E-Commerce store, the goal of criminals here is to get sensitive information through false order confirmations or get the user to suspicious websites. It’s good when it’s only false advertisement but it could link to viruses and the information can be used for hacking activity. If you are an owner of an E-Commerce store you should do your best to keep all client activity on the store’s website.

Identity Theft

When fraudsters get a hold of your customer’s personal data you are the real victim of identity theft. While banks are returning money on behalf of the victim, there is no real mechanism to secure your products in this case. So the best option here is to not let that go down, a real challenge for payment fraud detection. E-Commerce stores can also become a victim if they don’t provide enough security measures as in this case when data from 40 million credit cards were stolen.

Triangulation Fraud

This one is quite sophisticated and has a danger to be not detected at all, allowing criminals to use victims’ personal data over and over again. Let’s break it down to explain what’s going on:

• The fraudster makes a fake listing of an item at a very high price, which is perfectly legal on websites like Craigslist.

• The victim “buys” this item providing all personal data to the scammer

• A criminal orders the same item on another site and sends it to the victim keeping the profit to himself

Affiliate Fraud

This type of fraud involves hacking refer-a-friend programs in E-Commerce websites. It could be as easy as creating numerous fake profiles or using custom software to fool the business owner.

Supplier Identity Fraud

This one is targeted on business, not on its customers. The identity of your business partner could be stolen or his website pages hacked or replaced. Unfortunately, this one is quite common in B2B operations.

How to protect your business from Internet fraud

We had finally ready to look for E-Commerce fraud prevention best practices. Let’s begin with the steps when you don’t need specific tools.

PCI Compliance

No payment gateway can operate without adhering to Payment Card Industry Security Standards Council (PCI SSC). This is the world’s top standard to provide secure credit card transactions. You don’t have to deal with it if you are partnering with a payment gateway, however, if you decide to take on transactions on your side be ready for a rigorous procedure.

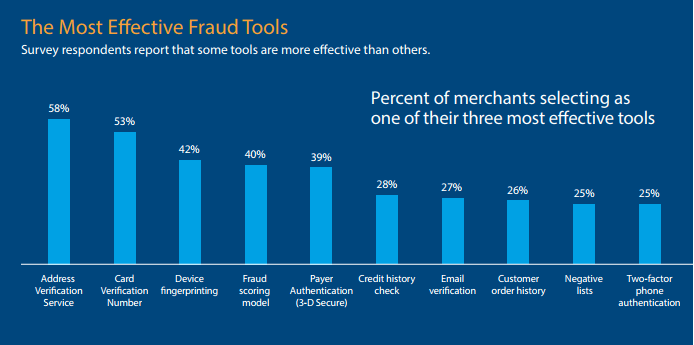

AVS and CVV

Address Verification Services (AVS) and Card Verification Value (CVV) are basic but very important measures to the security of your business. Most payment processors include these two. There is definitely something wrong with the processor if AVS and CVV are missing on the list of security measures.

Delivery Signature

In the variety of high-tech fraud, it is fascinating how simple things can save the day. So many issues can be solved and prevented with a good old physical signature!

Personal Follow Up

Act on as many suspicious activities if you can. If you have an opportunity you can make additional contact with your customer to make sure that everything is ok or even call the customer in case you find something strange. You can always delay the shipment of an order if something goes wrong, but is better for you and your customer to check twice.

Always use HTTPS

S, in this case, means Security and it could never be too much of it. HTTPS provides additional encryption and as a bonus ranks higher compared to HTTP in search engines!

Complex Passwords

So simple but yet so effective! Yes, sometimes it’s time-consuming to create a unique password for each account but adhering to a few requirements will cost you much less than the consequences of hacking.

Top 10 E-commerce fraud prevention tools

Good news – E-Commerce fraud prevention best practices include a ton of available software solutions! Here are just some of the best ones:

Riskified

A certain standout among other similar software. It provides very quick reporting in real-time – definitely a cutting edge software for a fraction of the price of an enterprise solution. You pay only for approved orders and it is very affordable and transparent with their system of analysis.

Kount

This is somewhat of a Ferrari in the world of E-Commerce security solutions. If you are ready to pay the price – the best technology will work for you analyzing hundreds of data points at a very fast pace. Kount is not really an option for small businesses.

Subuno

It is an affordable but powerful solution offering two dozen fraud detection tools covering more than a hundred possible fraud scenarios. If your security budget is not so big at the moment, but you still need the best protection this one might be for you.

DupZapper

Fast and simple installation are the prime advantages of this piece of software. It was initially created for online gaming, but it can be the solution that businesses any size can discover to be perfect.

FraudLabs Pro

It has some prominent technological security features that other solutions lack, but the most appealing to small businesses is their free plan that accepts hundreds of queries per month!

Forter

Flexible and customizable software that offers security for literally any transactions including tools for mobile payments and payment gateways.

Bolt

While this is essentially a checkout software, it scans hundreds of behavioral data points during the checkout that will not only give you valuable feedback but also ensure security.

Signifyd

Businesses of any size can look forward to using this software: it evaluates each purchase and provides you feedback on the legitimacy via score system. You can deal with suspicious cases yourself or ask for help from Signifyd.

Simility

This one focuses on the fingerprinting of devices determining the threat from it. If scammer already made some blacklist on a particular device, Simility fill find this out in no time!

Sift

“The world’s best machine learning for fraud detection” – this tag is appropriate for Sift. This solution is for large enterprises offering the most diverse, numerous, and efficient features possible for a great sum of money.

Machine learning for fraud detection

Speaking of Artificial Intelligence and Machine Learning, in 2020 they play a major role in fraud detection activities. While this topic deserves a separate article, let’s run through the most popular scams and how they could be dealt with thanks to ML!

Email Phishing Detection Models

Logistic Regression uses a linear model that provides a “yes” or “no” answer for the suspicious transaction. SVM, Naive Bayes, and Extreme Learning Machine can also be used for email phishing detection.

Identity Theft Detection Models

Unsupervised Machine Learning algorithms LOF, one-class SVM, Isolation Forest, and PCA are perfect for this anomaly detection challenge detecting abnormal patterns and suspicious actions by the user.

Credit card fraud detection using machine learning

Both supervised and unsupervised algorithms are suited great for credit card fraud detection using machine learning. Not only that, but neural networks can be useful here, but the lack of data for both normal and abnormal activities is the real challenge here.

“E-Commerce leaders will have to keep with these changes (and others) to survive and stay ahead.”

-Linda Bustos, Ecommerce Expert from Get Elastic

Conclusion

The war in the E-Commerce industry is on – while scammers improve their technological skills, the software solutions are the powerful answer to their criminal attempts. What you can do with that as a business owner? Choose the most suitable measures from this article, consider a custom solution, and keep your finger on the pulse of innovations like Artificial Intelligence and Machine Learning!