To sign up for our daily email newsletter, CLICK HERE

You might have built up an enviable chunk of savings with your hard work. But perhaps those savings would be wasting away in banks with the bare minimum interest rate return. We often wonder where we can park our money which would also generate us a good return. For all of our dreams, hopes and wishes for the future, such as saving up to send our eldest to college. Or even renovating the house. Or simply to grow the value of your wealth for future generations to benefit. For all of the small, medium and large sized investors seeking an avenue to increase your portfolio, we have discovered a solution. This is where we invite you to take a look at 500 Markets, an online trading platform.

500 Markets in a nutshell

500 Markets in Depth

Regulation

500 Markets is tightly regulated by the Financial Conduct Authority. They strictly follow Anti-Money Laundering (AML), Know-Your-Client (KYC) and Combatting the Financing of Terrorism (CFT) regulations.

Platform

500 Markets utilizes two different platforms. A web browser based platform and their Mobile application, downloadable for iOS and Android. The web trader platform is user friendly and easy to understand. Similarly, their mobile application is simple and quick to use. However, the mobile application does come with the downsides of clogging your phone’s storage and draining your battery. Whereas for Web trader, you will require a web browser to log in.

Trading Accounts

500 Markets offer a number of different trading accounts, each suited to unique client needs.

You can start trading with as little as $250, however, the disadvantage is their high commission’s for basic trading accounts.

Trading Products

Despite being a new entrant in the online trade sphere, 500 markets offers an enviable product umbrella.

Cryptocurrencies

A range of cryptocurrencies await the user. Ensuring that you have access to new age wallets and CFDs. This broker allows the client to access their trading account 24/7.

Forex

Conduct meaningful transactions with forex currency pairs.

Stocks

Simply put, an ownership into a company. Also known as equity or shares. 500 Markets offers all the blue chip stocks.

Indices

Top indices from around the world are available for you to allocate your investments in. Such as S&P 500 (USA), DAX 40 (Germany), FTSE 100 (UK), all are available via your 500 Markets account.

Commodities

Commodities are really lucrative for speculation. Top commodities such as crude oil, gold, coffee, wheat, corn and many more are accessible via 500 Markets.

Are Your Funds Safe and Secure With 500 Markets?

500 Markets have employed state of the art end-to-end encryption technology. The world of online trading is susceptible to hackers. Key private data such as your address or bank and credit card details are always at risk, therefore, 500 markets has ensured quality protection for the client. No third parties will ever have access to any of your information. Therefore, your funds and your identity are protected at all times.

Final Verdict: Where 500 Markets Shines and Where it Falls Short

Pros

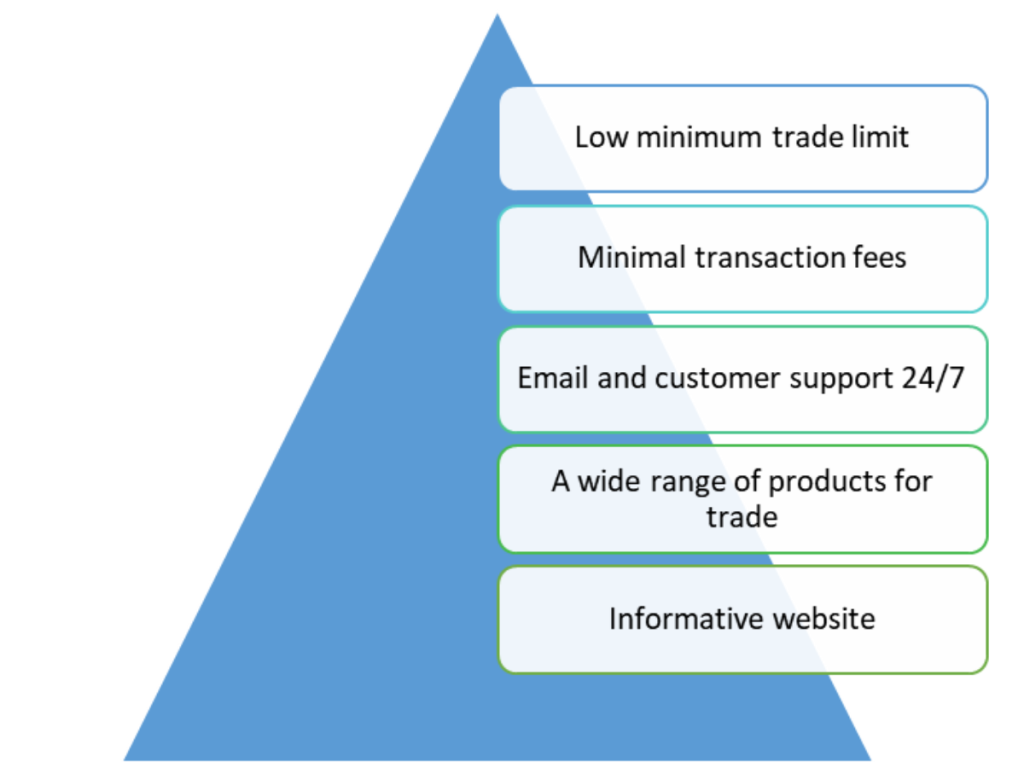

500 Markets is overall a great platform for small, medium and large investors seeking to maximize the value of their savings. They have ensured a variety of trading accounts for their varied clientele. A low minimum deposit level allows ease of access for small traders. Clients have the freedom to choose between a mobile application or a web browser or even use both.

Cons

500 Markets have a high fee structure for small accounts. It might not be the best option for small traders for whom every penny counts. Also, no stop loss feature risks your investment going in negative. Similarly, their mobile application is known to drain battery time as it runs in the background.

Overall

500 Markets may be a slightly expensive online broker but comparing it with other providers, it seems to be a reasonable choice for a standard investor. Also, since they are relatively new in the online trade sphere, they have ensured that they offer competitive products and trading conditions. Similarly, real time synchronization ensures effective decision making for the investor. They also offer basic training tools and charts to allow for informed decision making.