To sign up for our daily email newsletter, CLICK HERE

Click on any image to take you to the website

With more streaming services than ever before and a reported rise of over 20% in the number of over-the-top (OTT) households and the total hours spent watching OTT in the past two years (according to Comscore’s 2021 State of OTT report), the variety of programming choices and interest in potential consumption is practically endless. There is never any shortage of something to stream, in any category, at any given time.

Of course, this documented growth in streaming bodes well as we head into the NewFront advertising selling season, the digital media world’s answer to the broadcast upfronts.

“There is no doubt in our mind that streaming will be one of the most potent growth engines for the industry in the coming years,” noted David Cohen, CEO, Interactive Advertising Bureau (IAB) in a statement. “This new reality — where streaming is at the center of everything — demands a reset of how video is bought, sold, measured, and optimized. Consumers have already decided the future of media, and it’s streaming.”

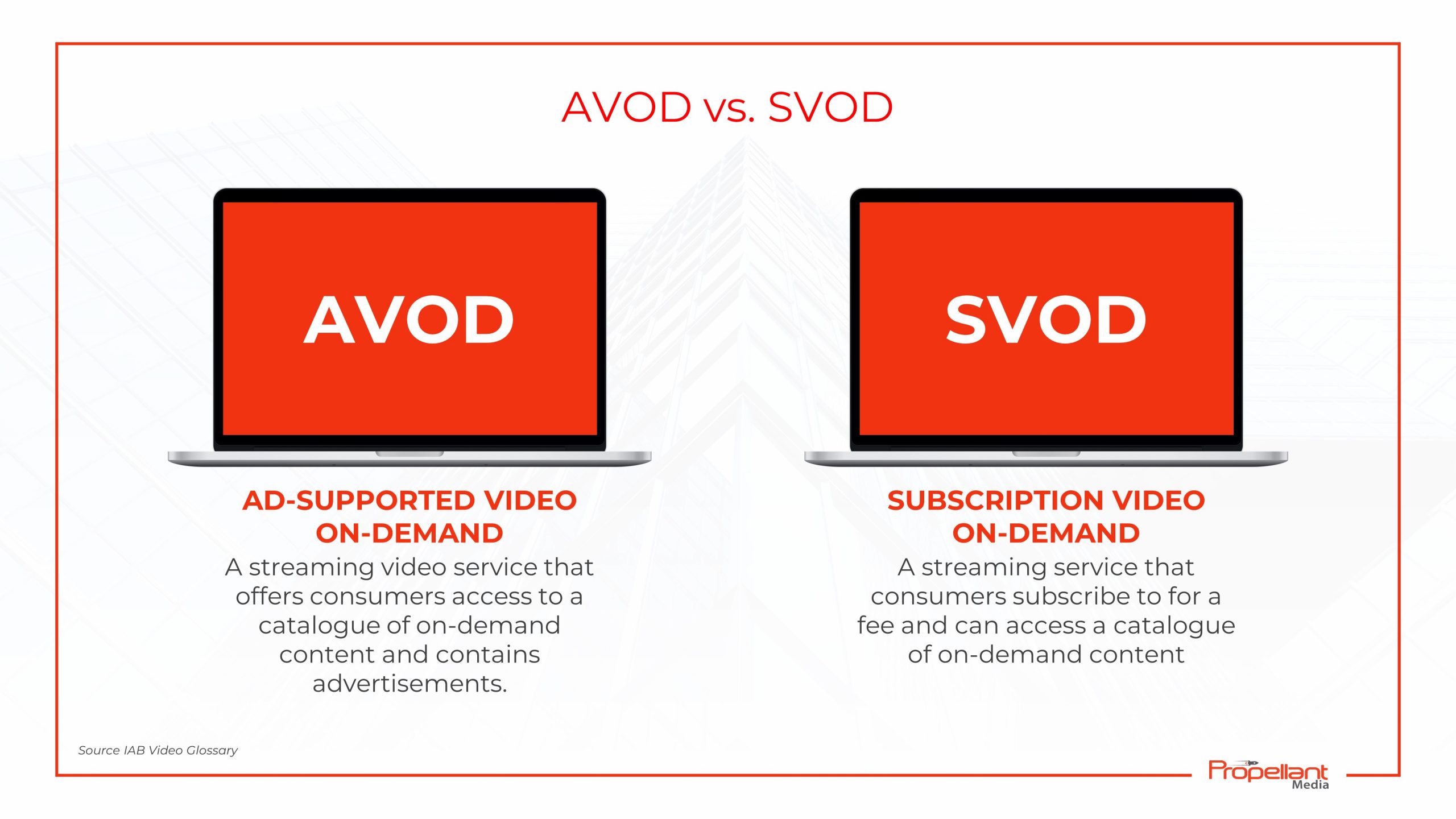

At present, the larger subscription video on demand (SVOD) platforms like Netflix, Amazon, Hulu and, now, Apple TV+ and HBO Max dominate at the Emmys (or any awards extravaganza), which only adds to their reputation of premium content and professionalism and why, of course, the digital landscape is so valuable for content seekers. But, for the end user, there better be a willingness to spend. SVOD does not come cheap and the latest research from Tubi indicates that even audiences with higher HHI are more rapidly adopting free, ad-supported video-on demand (AVOD) options.

The subscriber cost for Netflix alone, for example, recently rose by $1 to $9.99 per month. The standard U.S. subscription for Netflix now costs $15.49 per month, up from $13.99. And the premium plan was increased to $19.99 per month from $17.99.“Right now, the average household has approximately four SVOD subscriptions and that number is on the rise,” noted independent programming and media consultant Billie Gold. “While viewers might relish the program choices these SVOD services provide, it can take its toll on your finances as the costs increase. At some point, people are likely to pick a select few of their favorites and then settle in.”

On the flipside is AVOD, where an outlet like Tubi is never short of programming options (roughly over 40,000 different choices at press time), both original and licensed, and the cost is absolutely free. While the caveat, of course, are the advertisements, the ad-load at Tubi is below the market average (at about three to six minutes per hour) and it comes without any duplicate ads in the same pod.

“While most SVOD services also normally offer an AVOD option, or a combination of both to keep the cost down, the ads on Tubi are not intrusive to the content,” noted Robert Russo, president and CEO of RNR Media Consulting. “This only adds to the incentive of it already being free. You have nothing to lose and only to gain.”

The Rise of AVOD and Subscription Fatigue

“Last year, there was a great deal of momentum for the ad-supported video on demand space, and we predict 2022 as the year where AVOD market penetration is going to surpass SVOD,” explained Karl Dawson, Vice President of Audience Research at Tubi. “Presently, the gap in market penetration, which Comscore has singled out, is only about 3% percent between AVOD and SVOD households, with AVOD growing much faster than SVOD. If even a fraction of this continues, more homes will have AVOD than SVOD in 2022. More people have used one of these AVOD services recently and will continue to use them as a part of their entertainment services.”

Dawson also cites figures from MRI’s cord evolution, which shows a slightly lower growth rate at the individual level for both, but a similar gap, trend, and prediction.

“In both cases, one would expect more people to have AVOD and/or SVOD than ever before,” noted Dawson. “From there, of course, it is going to be up to the AVOD platforms to compete on content and experience. But for the consumers who want to save money without compromising on content, you have to wonder at what point they’re going to stop exploring paid services.”

According to Tubi, the average monthly cost for streaming in an average consumer household is about $65. In a household with one or two streaming services, the odds of having an AVOD service is only 20%. Once you get to three services, and as prices go up overall, the likelihood of that household having an AVOD service rises to about one-third.

“By the time you get to three streaming services, there is a greater than 30% chance that someone in the household watched AVOD,” explained Dawson. “And the probability of someone utilizing AVOD goes up to about 46% when there are five or more services in use.”

As the demand for OTT content continues to grow, the growth and reach of ad-supported OTT services over non-ad-supported services signals the value of the AVOD model.

According to market research firm eMarketer last fall, nearly 128 million people in the country were estimated to watch AVOD in 2021 — a rise of roughly 18% year-over-year, marking the first time that AVOD viewers made up more than half of all digital video viewers in the United States.

“As free AVOD platforms continue to be profitable we can expect to see their parent companies supply them more content in the form of original shows, news, or sports,” predicted Nazmul Islam, eMarketer forecasting analyst at Insider Intelligence in a statement.

Tubi: Past to Present

Launched in 2014 and acquired by Fox Corporation in 2020, Tubi is completely free with no strings attached. While creating a Tubi account allows viewers to have a more personalized experience on the platform and receive email updates about new content tailored to their specific taste, there is no need to sign in or provide any personal information. There’s something for everyone at Tubi, with a wide array of movies and TV series across genres including action, drama, Black cinema, LGBTQ+, cult classics, documentaries, horror, sci-fi, foreign language films, nostalgia, news, comedy and more. And specifically targeted buckets include Tubi Kids, Tubi en Español, News on Tubi and, now, Sports on Tubi, the latter a streaming destination for sports with 10 live streaming channels for different categories (including football, baseball, soccer, collegiate sports from the ACC and Pac-12 Conferences), as well as nearly 700 hours of on-demand sports content.

Launched in 2014 and acquired by Fox Corporation in 2020, Tubi is completely free with no strings attached. While creating a Tubi account allows viewers to have a more personalized experience on the platform and receive email updates about new content tailored to their specific taste, there is no need to sign in or provide any personal information. There’s something for everyone at Tubi, with a wide array of movies and TV series across genres including action, drama, Black cinema, LGBTQ+, cult classics, documentaries, horror, sci-fi, foreign language films, nostalgia, news, comedy and more. And specifically targeted buckets include Tubi Kids, Tubi en Español, News on Tubi and, now, Sports on Tubi, the latter a streaming destination for sports with 10 live streaming channels for different categories (including football, baseball, soccer, collegiate sports from the ACC and Pac-12 Conferences), as well as nearly 700 hours of on-demand sports content.

Tubi also launched its first slate of original content in 2021, including two new series: true crime docuseries “Meet, Marry, Murder” hosted by actress Michelle Trachtenberg, and adult animated comedy “The Freak Brothers” starring Woody Harrelson, Tiffany Haddish, John Goodman, and Pete Davidson. Original movies also include the upcoming rom-com “10 Truths About Love” starring Camilla Belle, premiering February 11; and “Corrective Measures” starring Bruce Willis and Michael Rooker, premiering later this spring. The service is expected to grow its originals output significantly in 2022.

Black History Month

Tubi is honoring Black History Month this month with two all-new originals that celebrate the value and the role of the African American community in U.S. history. The first original is musical drama “Howard High,” which is based on the 2020 miniseries (also available on Tubi in February) and follows a high school musical group that must compete against a rival school in order to save their arts program, while also battling issues from the inside. It began streaming on Friday, February 4.

Tubi is honoring Black History Month this month with two all-new originals that celebrate the value and the role of the African American community in U.S. history. The first original is musical drama “Howard High,” which is based on the 2020 miniseries (also available on Tubi in February) and follows a high school musical group that must compete against a rival school in order to save their arts program, while also battling issues from the inside. It began streaming on Friday, February 4.

The second is “Pass The Mic: A Movement Generations in the Making,” a two-hour Tubi Original documentary spotlighting the careers of Lil Nas X, Lizzo and Kendrick Lamar. It begins streaming on Wednesday, February 16.

“As home to the largest free collection of Black Cinema, Tubi is dedicated to empowering and elevating Black voices and stories year-round,” said Adam Lewinson, Chief Content Officer, Tubi. “We’re honored to celebrate Black History Month with a super-charged offering of premium programming.”Tubi, of course, also offers access to thousands of hours of movies and documentaries that highlight Black stories, voices and talent, further enhancing the value of the content streaming destination – all for free.

“As studios are reserving an increasing proportion of their content for their own platforms, AVOD platforms are beginning to follow suit and commission their own originals,” noted Tom Bell, an analyst with London-based research firm Ampere Analysis prior to the start of the current TV season. “While content exclusivity remains a key difference in strategy between AVOD and SVOD platforms, these early moves into original commissioning bring AVOD players a step closer to increasing their catalog exclusivity and quality and differentiating themselves in a crowded market.”

“As a free service, Tubi is already at an advantage as viewers seem willing to sit through the ad load,” said analyst Billie Gold. “And with their median age considerably younger than the average linear viewer, and a push towards original content, Tubi is well positioned for the future.

“Most importantly, we’re focused on providing our viewers with content they love and creating a great user experience, which we think sets us apart from other providers,” noted Tubi’s Karl Dawson. “This year, in general, will be streaming’s biggest year yet, and AVOD is going to be a huge part of that. Tubi will be at the forefront of stewarding that growth.”