To sign up for our daily email newsletter, CLICK HERE

In the dynamic world of online trading, investors are continually seeking platforms that offer innovative and efficient solutions. This CapitalClique review focuses on a broker that stands out in the digital finance arena. CapitalClique has positioned itself distinctively by integrating cutting-edge artificial intelligence (AI) technologies to transform the investment landscape. This introduction to CapitalClique will highlight its unique offerings and technological prowess, setting the stage for an in-depth exploration of the broker’s features and services.

CapitalClique is more than just a conventional online broker; it’s a testament to the fusion of finance and technology. By harnessing advanced AI, CapitalClique offers a refined investment experience that is tailored to the needs of modern investors. Its AI-driven platform not only simplifies decision-making but also enhances the accuracy and speed of transactions. Furthermore, CapitalClique’s technological capabilities extend beyond traditional markets, as it facilitates seamless operations both on and off-chain. This dual capability marks a significant evolution in brokerage services, allowing users to navigate multiple markets with ease and efficiency.

Our review will delve into the broker’s most notable aspects, unraveling what sets CapitalClique apart in the competitive realm of online trading.

CapitalClique Review: The Power of Advanced AI Algorithms in Investment Strategies

Intelligent, Data-Driven Investment Strategies

At the core of CapitalClique’s innovative approach lies its advanced AI algorithms. These algorithms represent a cornerstone in the broker’s commitment to offering intelligent, data-driven investment strategies. By integrating AI into its operations, CapitalClique transcends traditional investment methods, offering a more nuanced and effective approach to trading.

Real-Time Market Data Analysis

One of the most significant advantages of CapitalClique’s AI algorithms is their ability to analyze vast volumes of real-time market data. This continuous and comprehensive data analysis is critical in a landscape where market conditions can shift rapidly. The AI’s capacity to process and interpret this data ensures that investors are always operating with the most current and relevant information at their fingertips.

Predictive Analysis and Market Trend Anticipation

The predictive analysis capabilities of CapitalClique’s AI algorithms are particularly noteworthy. By evaluating market patterns and historical data, the AI can anticipate market trends, giving investors foresight into potential market movements. This level of predictive analysis enhances investment outcomes by allowing investors to make proactive, informed decisions.

Competitive Edge in a Rapidly Evolving Market

CapitalClique’s AI-driven approach equips investors with a significant competitive edge in the ever-evolving world of asset classes. As markets become more complex and interconnected, the ability to swiftly adapt and respond to new information becomes paramount. The AI algorithms at CapitalClique empower investors to stay ahead in this dynamic environment, making it a compelling choice for those seeking an edge in online trading.

CapitalClique Review: Elevating the Trader’s Experience through Enhanced Security Measures

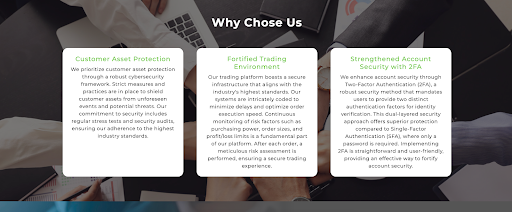

Customer Asset Protection

A key aspect of CapitalClique’s service is its steadfast focus on customer asset protection. The broker employs a robust cybersecurity framework, integrating strict measures and practices to safeguard customer assets. This includes conducting regular stress tests and security audits, a process that ensures compliance with the highest industry standards. By prioritizing the protection of customer assets, CapitalClique demonstrates a commitment to maintaining a secure trading environment.

Fortified Trading Environment

CapitalClique’s trading platform is designed with a fortified infrastructure, adhering to the industry’s most stringent security standards. The platform’s system architecture is expertly coded to minimize delays, thereby optimizing order execution speed. A key feature of this environment is the continuous monitoring of risk factors, such as purchasing power, order sizes, and profit/loss limits. After each transaction, a meticulous risk assessment is conducted. This approach not only ensures a secure trading experience but also instills confidence among traders in the platform’s reliability.

Strengthened Account Security with 2FA

In its pursuit to offer an unbreachable trading platform, CapitalClique has implemented Two-Factor Authentication (2FA). This security feature adds an additional layer of protection, requiring users to provide two distinct forms of identification before accessing their accounts. This method is far more secure than Single-Factor Authentication (SFA), which relies solely on a password. The implementation of 2FA is not only effective in enhancing account security but also user-friendly, striking a balance between heightened security and ease of use. By adopting 2FA, CapitalClique fortifies its account security, further elevating the overall safety of the trading experience.

CapitalClique Review: Maximizing Investment Potential for Traders

Lucrative Returns

CapitalClique emphasizes the potential for lucrative returns through its strategic approach to staking. By carefully selecting cryptocurrencies with promising prospects, the broker employs sophisticated staking techniques designed to maximize profits for its investors. This focus on selecting high-potential digital assets for staking purposes positions CapitalClique as a platform where the potential for growth is not only recognized but actively pursued.

Transparency and Ease of Use

Transparency is a cornerstone of the CapitalClique experience. The broker’s platform is designed to be user-friendly, providing real-time insights into clients’ staking activities. This transparency ensures that traders are always well-informed about their investments. The ease of accessing detailed, up-to-date information about staking activities empowers investors to make informed decisions, enhancing their ability to effectively manage and optimize their investment portfolios.

Dedicated Support

CapitalClique’s commitment to its clients extends beyond the trading platform. Recognizing that support is a critical component of successful investing, the broker offers dedicated assistance to its users. Whether a trader is new to staking or has extensive experience, CapitalClique’s team is readily available to provide answers, guidance, and personalized support. This commitment to delivering ongoing, comprehensive support underscores CapitalClique’s dedication to ensuring the success and satisfaction of its investors.

CapitalClique Review: Exceptional Customer Support for Traders

24/5 Availability

CapitalClique’s customer support stands out for its round-the-clock availability, which is operational five days a week. Understanding the global nature of trading and the need for timely assistance, the broker ensures that its clients can access support services whenever the markets are open. This 24/5 availability is crucial in providing immediate responses to urgent inquiries and issues, ensuring that traders’ activities are not hindered by a lack of support.

Multiple Contact Channels

To cater to diverse client needs and preferences, CapitalClique offers a variety of channels for customer support. Traders can leave a message using the website’s contact form, send an email, or make a phone call to get in touch with the support team. This flexibility allows clients to choose the most convenient way to communicate, ensuring that their specific needs are addressed promptly and efficiently.

Comprehensive Inquiry Handling

The scope of CapitalClique’s customer support extends to a wide range of inquiries. Whether traders have questions about the trading platform, account setup, technical issues, or any other trading-related concerns, the support team is equipped to provide comprehensive assistance. The broker’s dedication to offering detailed and helpful responses to all types of inquiries reflects its commitment to delivering a high level of service and support to its clients.

CapitalClique Review: Conclusion

In conclusion, this CapitalClique review has explored various facets of the broker, highlighting its commitment to leveraging advanced technology and providing top-tier services to its clients. CapitalClique distinguishes itself in the online trading arena through its innovative use of AI algorithms, enhancing investment strategies with intelligent, data-driven insights.

The broker’s focus on customer asset protection through a robust cybersecurity framework and fortified trading environment underscores its dedication to security and reliability. Furthermore, the implementation of Two-Factor Authentication (2FA) demonstrates a proactive approach to safeguarding client accounts.

CapitalClique’s efforts to maximize investment potential through lucrative staking opportunities and transparent, user-friendly platforms cater to both novice and experienced traders. The provision of dedicated support, available 24/5, with multiple contact channels, ensures that traders receive the assistance they need for a variety of inquiries, from technical issues to account management.

The broker’s comprehensive services, combined with a commitment to innovation and security, position CapitalClique as a decent player in the field of online brokerage. Its ability to adapt to the evolving demands of the market and to prioritize customer satisfaction and security makes it a viable choice for traders seeking an advanced trading platform.

Important Notice: The purpose of this article is solely to inform. The author does not take responsibility for the company’s actions in relation to your trading experience. Be advised that the information might not be the latest or most accurate. Any decisions in trading or finance made based on this content are your own responsibility. We do not guarantee the correctness of this information and are not liable for any financial losses that result from trading or investing.