To sign up for our daily email newsletter, CLICK HERE

Looking forward to welcoming a new baby? Congratulations. If you’re here, it means you’re seeking expert guidance on preparing your finances for the arrival of the latest family member. This is a crucial aspect of an expectant parent.

The importance of this education is underrated, as you could plunge into heavy debt and declare bankruptcy trying to train your child. But if it becomes inescapable, you can always consult an attorney to file bankruptcy and eventually understand its benefits. Yes. Taking care of a baby costs a lot, and a responsible financial plan will certainly provide a soft landing as you strive to meet your financial goals.

According to previous studies, it is possible to spend between CAD10,000 and CAD15,000 on a child per year. The relevant and somewhat complicated intricacies of financial planning will be taken off here, as we provide a step-by-step guide on what to do to provide a safe landing for your kid, financially.

Before Arrival of Baby

This is the first stage and chance you have to begin the process of planning your kid’s future. It involves good research and planning. The following tips should be on your to-do list before your kid’s arrival.

Create a Budget Pre-Arrival

First, start out with a list of items that may require huge funding. Strollers, a baby car seat, a crib, etc., could be among the supplies you may need. In essence, cash-intensive purchases you feel may be necessary should be on this list.

Remember that it should be only essential items. It may be a long road ahead, and you want to avoid getting cash-strapped. Look out for the prices, and compare between sellers for the best option. Sourcing for funds could be a challenge. Thankfully, there are several options you could check, including researching the best payday loan lenders. There are several guaranteed payday loans no matter what Canada 24/7 services to check. It is a great way to relieve pressure while planning for your baby.

Take Advantage of Maternity Leave

Using a maternal or paternal leave offers you options to save money while planning the next step with your partner. There’s the Employment Insurance package, which could be beneficial to you as an expecting parent.

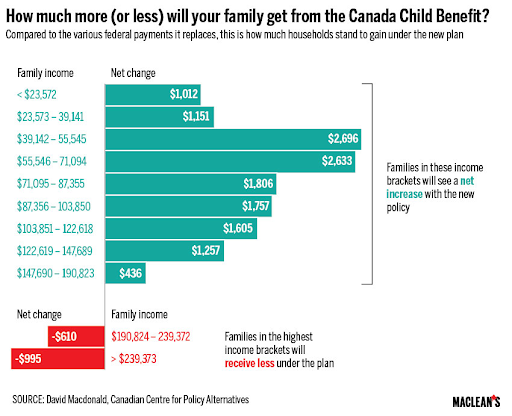

Be sure to talk to HR about what it covers, including benefits and other government amenities (if available). A common offer is the Canada Child Benefit (CCB) plan, for which you can file an application immediately after birth. It is tax-free, and is paid every year until your baby turns 18.

Rainy-day Funds Savings

It is possible to run out of funds at emergency times. For this reason, separate emergency savings can be a helper. This will serve as a first defense when unexpected expenses come up, and you don’t need to dip in your investments.

Long-Term Investments

Amidst the excitement and plans, it is a great time to consider having an investment in your baby’s name. The first one should be life insurance, if available. Make inquiries on how to expand your beneficiaries list. An education trust fund or investment plan will be awesome, too, for your child’s post-high school education.

If possible, they should be part of tax-free incentives, so the dividends do not reduce. Don’t forget to keep contributing towards your retirement investments, especially if you decided to have a child late.

Save As Much as Possible

Between the rainy day funds and investment, you could have an intermediary savings plan, which can also increase your budget. Some tips here include:

- Use reward programs to gather points. Is it possible to gain points when using a credit card to purchase? This can guarantee you additional points redeemable at baby retail stores.

- Compare the options between pre-loved and New items. Chances are you can find used baby supplies from family and friends at cheap prices. This can help you save as much as possible.

After Arrival

Now, your baby is here. And you’re holding his/her tiny fingers in your palm. Here’s the time to manage different cost implications.

Submit a Registration for your Child

The first step is to notify the government of your child’s birth. Get a birth certificate within your province. The procedures may vary between territories. The importance of this financially is to ensure your baby gets a Social Insurance Number as well as a health card.

Ensure all Expenses are Accounted for

To show you’re responsible for your finances, it is important you have a checklist of all expenditures made, especially within the first 6 months post-birth. It is easy to lose track between caring for the baby and working.

Here’s a simple hack: for all diapers, baby food, and clothing, a simple spreadsheet will be enough. This will help you know how much has been spent and where you may need to manage more.

Child Daycare

As the first birthday approaches, it is time to consider what daycare options are available. It is challenging finding good childcare options, since the law stipulates a particular number of kids per space, aside from nursery schools.

The reason why you should begin planning is that it is expensive, and may not be sustainable. Besides, finding that quality child daycare is challenging and could be a while. The types of daycare available vary from one province to another.

A majority of parents rather opt for an unregulated daycare option, like a live-in nanny or contract babysitter. To save cost, make inquiries on what the rates are before starting out to find one.

To save costs, you could make your choices based on recommendations from family and friends. It’s also a great idea if you have a daycare centre at your office. The benefit is that it will be cheaper for staff, saving you the time and stress of picking your child up from a centre far away.

Keep Stashing Funds as Rainy Day Savings

With kids, anything can happen. The basic idea is to care for your baby while not touching your investments. This can be done by putting a part of your budget into a separate account.

Bottom Line

Planning financially for the arrival of a newborn is not easy. However, you can relieve some pressure with research on the funding options available to you. Taking advantage of government benefits, and reliable payday lenders, is instrumental.

Don’t forget to adjust your will and life insurance to accommodate the newest family member. Proper insurance and strict instructions for the management of your estate will set your child on a good landing pad in life.