To sign up for our daily email newsletter, CLICK HERE

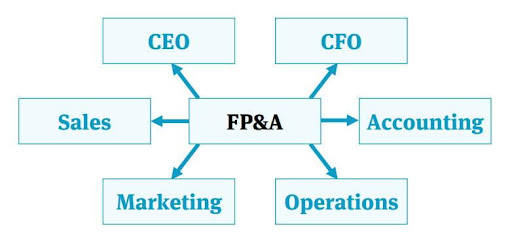

Data has evolved into a crucial asset for organizations to make educated decisions in today’s fast-paced business environment. Professionals in financial planning and analysis (FP&A) are essential in understanding complex financial data and providing useful insights.

To do this, they want strong software that can manage massive datasets, carry out sophisticated data analysis, and show data in a visually appealing way. In this space, Microsoft Power BI emerges as a game-changer by empowering FP&A professionals to turn data into insightful knowledge that informs strategic decision-making.

The Evolution of FP&A and the Role of Data Analysis:

Over time, FP&A professionals’ roles have undergone tremendous change. The days of manually manipulating spreadsheets are long gone, and today’s FP&A experts must analyses enormous amounts of data to help inform strategic financial decisions.

Financial data complexity rises significantly as firms expand and diversify. Here, Power BI’s features come into play, providing a flexible platform for sophisticated data analysis and visualization.

1. Streamlining Data Integration: Connecting Data Sources

FP&A workers frequently struggle with data that comes from numerous sources, including external databases, CRM software, and ERP systems.

These professionals may connect to many data sources and combine information in real time thanks to Power BI’s frictionless data integration. This not only saves time, but also guarantees data consistency and accuracy.

2. Transforming Raw Data into Actionable Insights: Data Modeling

Raw data has the potential to yield insightful information, but it must first be cleaned up and organized. With the help of Power BI’s data modelling features, FP&A specialists may establish data linkages, specify computations, and develop measures that precisely reflect business metrics.

This process is essential for transforming unprocessed data into insights that can be used to guide decision-making.

3. Advanced Analytics: Uncover Trends and Patterns

Power BI provides FP&A professionals with sophisticated analytical tools beyond simple visualization. They have access to tools like the DAX (Data Analysis Expressions) language and built-in functions, which allow them to carry out intricate computations and develop unique metrics.

In-depth analysis is made possible by this capabilities, including trend identification, variance analysis, and scenario modelling.

4. Interactive Dashboards: Visualizing Complex Financial Data

The capability of Power BI to produce interactive dashboards with eye-catching visuals is one of its major features. Professionals in FP&A can create detailed dashboards that show the most important financial information, performance indicators, and projections.

Users can dive down into specific data points using interactive features like slicers and filters to acquire insights from various perspectives.

5. Real-time Monitoring and Reporting: Timely Decision-Making

Timing is everything in the financial industry. FP&A Power BI experts may develop real-time dashboards using Power BI that provide an overview of the current financial picture.

As a result of this real-time monitoring, stakeholders are better equipped to respond quickly to market changes and strategic opportunities.

6. Collaboration and Sharing: Enhancing Communication

Collaboration across functional lines requires effective financial insight communication. FP&A experts can securely share dashboards and insights inside the company using Power BI.

The platform offers choices for configuring access levels, making sure that various stakeholders receive the appropriate level of information. As a result, teams are more aligned and have a better grasp of financial performance.

7. Predictive Analytics: Shaping Future Strategies

For FP&A professionals, predictive analytics is a game-changer since it gives them the ability to predict future financial events based on historical data and trends.

These experts can develop predictive models and produce projections that direct long-term strategic planning thanks to Power BI’s integration with machine learning algorithms.

8. Data Security and Compliance: Safeguarding Financial Information

Financial data security cannot be negotiated. Role-based access control and encryption are two elements that Power BI uses to protect data.

For FP&A workers who handle sensitive financial information and must adhere to industry regulations and data protection standards, this is extremely important.

9. Training and Adoption: Building FP&A Teams’ Capabilities

Power BI has a tons of sophisticated features, but an organization’s ability to successfully deploy it hinges on how well-trained its FP&A employees are. For the technology to be used to its maximum capacity, these specialists must receive the appropriate training and materials.

By making an investment in skill development, FP&A professionals can securely use Power BI’s functionalities to create impactful data analysis.

10. Customization and Personalization: Tailoring Insights to Different Audiences

To effectively carry out their duties, many stakeholders within an organization need different types of information. FP&A professionals can tailor dashboards and reports using Power BI to meet the unique requirements of varied audiences.

Professionals may build graphics and analytics that engage with each group, whether presenting to the C-suite, department heads, or operational teams, resulting in more fruitful discussions and choices.

11. Data Visualization Best Practices: Communicating Insights Effectively

It takes a combination of imagination and clarity to master the art of data visualization. Charts, graphs, maps, and tables are just a few of the many visualization choices that Power BI provides.

These options can be used by FP&A experts to produce visually appealing representations of difficult financial data. By following best practices for data visualization, such as picking the suitable chart type and color palette, insights are effectively communicated.

12. Integration with Excel and Office 365: Seamless Workflow

Excel and Office 365 are just a couple of the Microsoft Office applications that Microsoft Power BI easily connects with. For FP&A experts who are already familiar with these apps, this integration simplifies the workflow.

To increase productivity and shorten the learning curve, they can directly import Excel spreadsheets, pivot tables, and other data into Power BI.

The Bottom Line:

FP&A experts are at the forefront of promoting well-informed decision-making in the constantly changing world of finance. They are given a potent toolkit by Microsoft Power BI to fully utilize the potential of data and turn it into insights that can be used to determine the organization’s future.

Power BI improves every step of the FP&A process, from speeding data integration to predictive analytics, making it a crucial tool for contemporary financial professionals. Adopting Power BI is not simply a choice; it is a strategic need as businesses continue to navigate complex financial landscapes.