To sign up for our daily email newsletter, CLICK HERE

Nobody wants to be in a situation where their car breaks down and they don’t have the money to fix it. If this happens to you, don’t panic! There are ways to get the cash you need quickly, like get a 1000 dollar loan now so you can get your car back on the road. In this blog post, we will discuss five steps that will help you get the money you need for auto-repair. Follow these steps and you will be on your way to getting your car fixed up and back on the road!

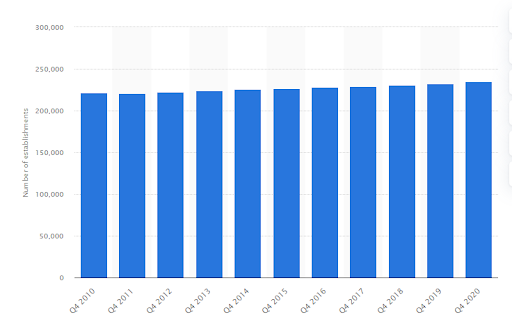

Car Breakdowns: The Statistics You Need to Know

Car breakdowns are always frustrating especially when you are short of cash. But whatever the case, you’ll need to figure out what the problem is considering the amount of money you used to buy it. For example, according CarGurus, a van costs $34,284, a BMW costs $35,549 while a Chevrolet costs $30,581 on average.

The amount used to buy the car is high and hence you’ll need to maintain it well to survive for a longer time. Car repairs are unavoidable. Once in a while, your car will get a puncture which will necessitate a repair.

One report from Statista showed that in the last quarter of 2020, around 234,700 auto repair and maintenance centers were present in the U.S indicating a 0.9% increase from the previous year.

So, how can you get the money to buy the auto parts or get the auto repair service?

How To Get Money Fast For Auto Repair

There are various sources to get fast money for auto repair. The fast and most effective option is your emergency savings. This option is interest-free and easy to access. But it’s not always that we have the savings available to grab. The savings might be on a fixed account where they are not available or if they are available, they are not enough.

How will you deal with this situation? You can consider taking out a loan. Here are some examples of auto repair loan types to consider.

1. Personal Loans For Auto Repair

Personal loans for auto repair are types of installment loans where borrowers loan out a certain amount and repay it in installments. The total amount you’ll pay for the installments will be higher than the amount you borrowed due to the interests added. Personal loans have an average interest of between 9% to 36%.

To be approved for the loan, you’ll need to have a good credit score. A good credit score ranges from 750 and above but you can also get a pretty good offer with a score of 720.

If you have a lower score, you can consider taking options like securing the loan with collateral like the car, getting a cosigner, or getting the personal loans for bad credit. The latter option will however have high interests but it can help.

You can get personal loans between one and seven days depending on the type of lender you are borrowing from. The loans can be accessed from traditional banks, online lenders, and credit unions.

2. Credit Cards

Credit cards are the type of revolving credits where you’ll get access to funds as long as you continue to make the regular payments at the due time. The interest rates vary and are charged when the funds in the borrower’s account are used.

Again, credit cards can be used to purchase almost everything including the auto parts. If you need a loan for an auto repair, you can consider using the credit card cash advance option where you will get a loan against the funds in your account. The interest rates will however be relatively higher than the normal credit cards.

If you manage to pay the full credit in due time, you’ll get 0% introductory rates, meaning no interest will be incurred on the normal credit cards. Also, paying the credit in time will increase the chances of getting an increase in your credit limit.

However, you can roll over your credits to the next month but you’ll incur additional interests which if you are not careful, can put you into a debt cycle.

3. Payday Loans

Payday loans are short-term loans that have a very fast approval time and little documentation included. The only requirements you’ll be asked for are your proof of identity, proof of stable income, and an active account for depositing the funds. The loans can be granted a few minutes to one hour from the time of application.

These loans are unsecured hence no security is needed and no credit checks are done. They can be used for anything including paying for the auto glass repair or whatever type of car repair you have. The amount granted ranges depending on the lender but it’s normal to get a 1000 dollar loan now.

Well, they may sound so perfect but the main drawback is the high interests included. They typically have an APR of over 400% meaning you’ll be charged for an additional amount of between $10 to $30 for every $100 borrowed.

The high interests can leave you in a huge debt cycle if you are not well planned on the repayments hence you need to be careful when getting these loans. But if you have a good repayment plan, payday loans for auto repair can be a great option.

4. Personal Lines of Credit

Personal lines of credit are similar to credit cards as they are also a type of revolving credit. That means you have access to some funds as long as you make regular payments with the interests included. The interest rates are calculated based on how much you use hence they are variable. If you take smaller amounts, you’ll incur a smaller interest.

The personal lines of credit are unsecured meaning that the risk of default is pretty high. For this reason, the loans have pretty high interests but not as high as payday loans. Their approval period is however longer than the payday loans. The funds can be accessed through lines of credit checks or in bank transfers.

5. Title Loans

Title loans are short-term loans that have to be secured during application. You can use your car as security where the car will go through a screening process to determine its value. You’ll then be granted the loan depending on the value of the car. The amount ranges between 25% to 50% of your car’s value.

Title loans can be applied physically or online. However, you’ll still need to take the car to the physical loan institution for inspection even in the case of an online application. You’ll also need to have proof of ownership of the car, car insurance, and a driver’s license.

Title loans have an average APR of 300% hence they are quite high. You need to be cautious about the high interests involved to prevent missed payments and the negative consequences that follow.

Conclusion

Getting money for auto repair is not difficult. You’ll need to do your research to find the best option that closely meets your situation.