To sign up for our daily email newsletter, CLICK HERE

In the rapidly evolving landscape of cryptocurrency trading, staying ahead of the curve requires more than just a keen understanding of market trends. Successful traders are those who are equipped with the right tools and programs to interpret complex signals and make informed decisions.

This comprehensive guide aims to provide you with an in-depth overview of the essential programs you need to know to trade crypto signals Telegram effectively. From chart analysis to risk management, we’ve got you covered.

Why Is the Right Software Important for Quality Crypto Trading?

The right software is pivotal in achieving quality crypto trading due to its role in optimizing efficiency, accuracy, security, risk management, order execution, and overall trading experience. It empowers traders to make informed decisions, adapt to market changes swiftly, and manage their portfolios effectively in a dynamic and competitive environment.

Let’s talk in detail about why it’s so important to use decent programs in crypto trading.

- Efficiency and Speed: The cryptocurrency market operates 24/7, and prices can change rapidly. High-quality trading software is designed to execute orders swiftly and efficiently, enabling traders to take advantage of market movements without delays. A delay of even a few seconds could result in missed opportunities or unfavorable trades.

- Accurate Data Analysis: Making informed trading decisions requires access to accurate and up-to-date market data. Quality trading software provides real-time price feeds, historical data, technical indicators, and charting tools. These features help traders analyze trends, patterns, and signals to make informed predictions about market movements.

- Security: Cryptocurrencies are digital assets, and the security of your trading activities is of utmost importance. Reputable trading software employs robust security measures such as encryption, two-factor authentication, and secure API connections to safeguard your account and funds from potential breaches.

- Risk Management: Effective risk management is crucial in crypto trading. The right software provides tools for setting stop-loss and take-profit levels, as well as offering position sizing calculators. These features help traders manage their risk exposure and limit potential losses.

- Automation and Algorithms: Some traders prefer to use algorithms or bots for automated trading strategies. The right software allows users to implement these strategies effectively, automating trading actions based on pre-defined rules and criteria.

#1 – Cryptocurrency Chart Analysis Software: Unlocking Insights

Cryptocurrency prices are notorious for their volatility, which can present both opportunities and risks. To navigate these fluctuations successfully, traders rely heavily on chart analysis software. This software allows you to visualize price movements, patterns, and trends over different time frames, helping you make informed decisions about when to buy or sell.

Key Features to Look For

When selecting chart analysis software, consider features such as technical indicators, drawing tools, and the ability to overlay multiple charts. Platforms like TradingView and Coinigy provide a wealth of customization options, helping you tailor your analysis to your specific trading strategy when trading free crypto signals.

One Good Example – TradingView

TradingView is a widely used online platform for charting and technical analysis in the financial markets, including cryptocurrencies. It offers a range of features designed to assist traders and investors in making informed decisions. Here are some of its main features:

- Advanced Charting: TradingView provides highly customizable and interactive charts with a variety of timeframes, chart types, and drawing tools. Traders can add indicators, trend lines, and other graphical elements to analyze price movements.

- Technical Indicators: The platform offers a vast selection of technical indicators, such as moving averages, MACD, RSI, and more. These indicators help traders identify trends, momentum, and potential entry/exit points.

- Drawing Tools: Traders can annotate charts with various drawing tools, including trendlines, Fibonacci retracements, and shapes. This allows for detailed analysis and the identification of important levels.

- Watchlists: Users can create and manage watchlists to track multiple assets and their price movements in real time.

- Social Interaction: TradingView has a social aspect, allowing users to share their analysis, ideas, and charts with the community. This fosters collaboration and information sharing among traders.

- Alerts and Notifications: Traders can set up alerts based on price levels, indicator conditions, or other criteria. This feature helps users stay informed about market movements even when they’re not actively watching the charts.

- Integration: TradingView can be integrated with various brokerages, enabling traders to execute trades directly from the platform.

- Educational Resources: TradingView provides tutorials, articles, and educational content to help users learn about technical analysis and trading strategies.

#2 – Automated Trading Bots: Enhancing Efficiency

In the fast-paced world of cryptocurrency trading, every second counts. Automated trading bots have gained immense popularity due to their ability to execute trades based on predefined parameters without the need for constant manual oversight. These bots can react to market signals swiftly, helping you capitalize on favorable conditions even when you’re away from your screen.

Choosing the Right Bot

Selecting the right automated trading bot requires careful consideration. Look for bots that offer customizable strategies, real-time monitoring, and compatibility with major exchanges. Popular options include 3Commas and Cornix trading bot, both of which offer a range of features to suit different trading styles.

One Good Example – Cornix Trading Bot

Cornix is a popular cryptocurrency trading bot that automates trading strategies on various exchanges. It aims to simplify the process of executing trades based on predefined criteria. Here’s a brief overview of Cornix:

- Automation: Cornix allows users to set up and automate trading strategies using a simple interface. Users can define conditions for buying, selling, and managing positions, all without requiring manual intervention.

- Integration: Cornix integrates with multiple cryptocurrency exchanges, allowing users to execute trades across different platforms while managing their strategies from a centralized dashboard.

- Risk Management: Cornix includes features for setting stop-loss and take-profit levels, as well as adjusting position sizes based on predefined risk parameters. This helps users manage their risk exposure and potential losses.

- Customization: The bot offers flexibility in terms of strategy customization. Users can adjust settings such as entry and exit criteria, trade size, and other parameters to align with their trading preferences.

- Backtesting: Cornix allows users to backtest their trading strategies using historical data to evaluate their effectiveness before deploying them in real markets.

- Market Coverage: Cornix supports a wide range of cryptocurrency pairs on different exchanges, offering traders the opportunity to diversify their trading activities.

#3 – Portfolio Management Software: Mitigating Risk

Successful crypto trading isn’t just about making profitable trades; it’s also about managing risk. Portfolio management software plays a crucial role in helping traders diversify their investments and minimize potential losses. These programs allow you to track your holdings across various exchanges and wallets, providing a comprehensive view of your overall exposure.

Features to Seek

When evaluating portfolio management software, prioritize features such as performance tracking, real-time portfolio value updates, and tools for setting stop-loss and take-profit orders. Applications like Delta and Blockfolio are renowned for their user-friendly interfaces and extensive coin support.

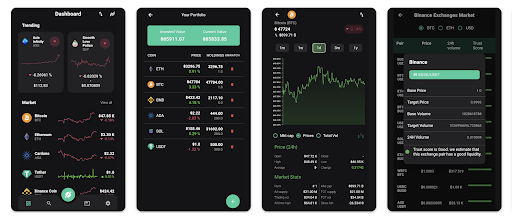

One Good Example – Blockfolio

Blockfolio is a widely used cryptocurrency portfolio tracking app that helps users manage and monitor their cryptocurrency investments. Here’s a brief overview of Blockfolio:

- Portfolio Tracking: Blockfolio allows users to track the performance of their cryptocurrency holdings in real time. Users can input their transactions, including purchases and sales, to accurately calculate their portfolio’s value and gains/losses.

- Real-Time Price Tracking: The app provides real-time price updates for a wide range of cryptocurrencies from various exchanges, allowing users to stay informed about market movements.

- Price Alerts: Users can set up price alerts for specific cryptocurrencies. When the price reaches a certain level, the app sends notifications, helping users make timely decisions.

- Charts and Graphs: Blockfolio offers interactive price charts and graphs for each cryptocurrency, helping users visualize historical price movements and trends.

- Exchange Integration: Blockfolio integrates with many cryptocurrency exchanges, allowing users to automatically sync their transactions and balances for a more accurate portfolio overview.

- Customization: Users can customize their portfolio by adding the cryptocurrencies they own, specifying transaction details, and arranging the display to suit their preferences.

- Sync Across Devices: Users can sync their Blockfolio accounts across multiple devices, ensuring they have access to their portfolio information wherever they go.

#4 – Fundamental Analysis Tools: Informed Decision-Making

While technical analysis is essential, successful crypto trading also involves understanding the underlying fundamentals of each cryptocurrency. Fundamental analysis tools help you assess the viability and potential of different coins by analyzing factors such as team credentials, partnerships, and market adoption.

Key Features to Look For

Look for tools that provide comprehensive information about each cryptocurrency, including news updates, project developments, and social sentiment analysis, which are very useful for trading with BitMEX signals. Websites like CoinMarketCap and CoinGecko offer a wealth of data to aid your fundamental analysis efforts.

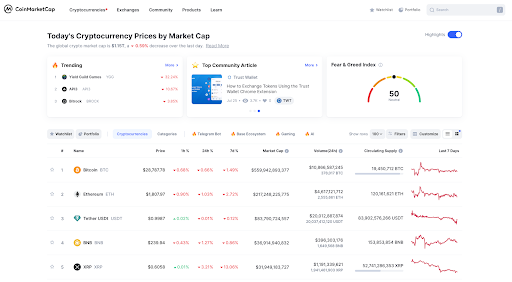

One Good Example – CoinMarketCap

CoinMarketCap is one of the most well-known and widely used platforms for tracking and analyzing cryptocurrency prices, market capitalization, trading volume, and other market-related data. Here’s a brief overview of CoinMarketCap:

- Cryptocurrency Data: CoinMarketCap provides a comprehensive list of thousands of cryptocurrencies, along with real-time and historical data on their prices, trading volumes, market capitalization, and more.

- Market Metrics: The platform displays key metrics such as market capitalization, trading volume, circulating supply, and total supply for each cryptocurrency, allowing users to quickly assess the relative size and importance of different tokens.

- Charts and Graphs: The platform provides interactive price charts and graphs for each cryptocurrency, enabling users to analyze historical price trends and patterns.

- Market Overview: Users can see the overall market performance, including total market capitalization, trading volume, and the dominance of major cryptocurrencies like Bitcoin and Ethereum.

- Exchanges and Pairs: CoinMarketCap lists the exchanges where each cryptocurrency is traded, along with the trading pairs available on those exchanges.

- News and Updates: The platform offers news articles and updates related to the cryptocurrency industry, helping users stay informed about developments that might impact their investments.

- Cryptocurrency Rankings: CoinMarketCap ranks cryptocurrencies based on various factors, such as market capitalization. This allows users to quickly identify the most prominent cryptocurrencies.

- API Access: CoinMarketCap offers API access for developers and businesses that want to integrate its data into their own applications or services.

#5 – Security and Privacy Solutions: Safeguarding Your Assets

In the world of cryptocurrency, security is paramount. With the potential for hacks and breaches, safeguarding your assets should be a top priority. Security solutions like hardware wallets and encrypted communication tools help protect your holdings and sensitive information from malicious actors.

Ensuring Protection

When choosing security solutions, opt for reputable hardware wallet brands such as Ledger and Trezor to store your cryptocurrencies offline. Additionally, utilize encrypted messaging apps like Telegram or Discord to communicate securely with fellow traders and investors.

One Good Example – Discord

Discord is a popular communication platform originally designed for gamers, but it has since evolved into a versatile tool used by various communities, including cryptocurrency enthusiasts, traders, developers, and more. Here’s a brief overview of Discord:

- Communication: Discord provides text, voice, and video communication channels that allow individuals and groups to interact in real time. Users can join servers, which are like virtual communities or groups centered around specific interests.

- Servers: Servers are where users gather to discuss and share content related to a particular topic or interest. Cryptocurrency-related servers, for example, can include discussions about market trends, trading strategies, news, and technical analysis.

- Channels: Servers are organized into channels, which are specific sections or topics within a server. Channels can be dedicated to different subjects, making it easy for users to navigate discussions.

- Voice and Video Calls: Discord supports voice and video calls, allowing users to engage in conversations with others individually or in groups. This is particularly useful for live discussions, interviews, or collaborative work.

- Direct Messaging: Users can send direct messages to individuals or create group direct messages for private conversations.

- Bots: Discord supports bots, which are automated programs that can perform various tasks, such as moderating discussions, providing information, or playing games.

- Mobile App: Discord offers a mobile app for iOS and Android devices, allowing users to stay connected and engaged even while on the go.

Conclusion

As you navigate the dynamic realm of crypto trading, equipping yourself with the right programs is essential for making informed decisions and staying ahead of the competition. From chart analysis to security solutions, each of these programs plays a crucial role in your journey toward becoming a successful crypto trader.

If you’re ready to take your crypto trading skills to the next level and maximize your chances of success, integrating these programs into your trading strategy is a step in the right direction. Remember, the crypto market is ever-evolving, and staying adaptable while utilizing the latest tools is the key to thriving in this exciting landscape.