To sign up for our daily email newsletter, CLICK HERE

The evolution of the securities trading industry has been influenced by the introduction of electronic execution mechanisms. Due to the increasing number of firms and individuals using electronic trading platforms, the focus of the industry has shifted to the use of fully integrated trading systems.

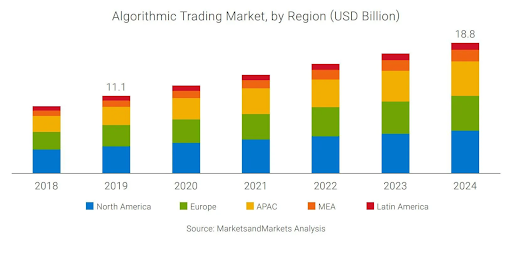

The global algorithmic trading market is expected to grow from 11.1 billion in 2019 to 18.8 billion by 2024.

Through the use of algorithmic trading platforms, market participants can now make orders without the need for human intervention. This technology eliminates the need for manual intervention and allows them to achieve market quality and volatility through the use of quantitative models. Despite the widespread discussion about the pros and cons of this type of trading, little is known about the typical mistakes that need to be avoided by traders.

The increasing popularity of algorithmic trading has led to the emergence of various market-related technologies. These include the development of new trading platforms and the enhancement of existing ones. The main difference between algorithmic trading and human traders is that the former focuses on market data and the latter on the execution of orders.

A study conducted by Peter Gomber and Markus Gsell of the Center for Financial Studies analyzed the difference between manual and algorithmic trading. They found that it is more efficient than human-led trading.

The study conducted through a Chi-Square test revealed that algorithmic trading is fundamentally different from human-led trading in that it focuses on market data and not on the execution of orders. It also shows that the systems can modify and monitor the orders that they receive. The researchers concluded that this type of trading is beneficial for market participants because it allows them to react quickly to market movements.

Three mistakes of trading system development

Most traders spend their time developing strategies and techniques in order to achieve their goals. There’s basically two ways traders can choose in order to get set for the algo trading: buying a ready-made trading robot or building one themselves. Unfortunately, the latter can lead to many mistakes as the participants make numerous shortcuts.

There are several popular trading communities that focus on learning, networking, and knowledge sharing. For example, the MQL5.Community is built as a unified place for traders and developers featuring different things: from a freelance marketplace for hiring an algo trading developer to a built-in chat to directly get help from fellow traders in case of any issue.

Despite the advantages of algorithmic trading, there are still many common mistakes that traders make when building their trading system that can lead to their failure in real-time trading. Some of these include not knowing how to use the system properly and making the wrong decisions. Kevin J. Davey described the most common mistakes in algo trading before one even starts trading:

#1. Complications & Obfuscations

One of the most common mistakes that traders make is the development of a system overcomplicated. Many of them think that this process is the way to develop a strategy. They believe that the more indicators that the system can utilize, the better its chances of succeeding.

Unfortunately, this process can lead to many mistakes as the participants make numerous shortcuts. One of the most common mistakes that traders make is the development of a system that features multiple rules. Doing so only gives them a false sense of confidence and does not improve the system’s performance in the future.

“Simple approaches are usually the best.”

#2. Friction free trading

When looking at a trading system for sale, you’ll likely notice that it doesn’t include commissions and slippage. Many do-it-yourself developers also don’t include these costs in their development fees, which usually leads to an underestimate.

Jesper Christensen teaches other MQL5.community members how to apply fees so that the results of your backtests will match those of your live results.

Friction-free planning leads to the trader taking more trades than they need. For instance, there’s a scalping system that can earn $300 a day before it has to pay commissions and slippage. On the other hand, System B only trades once a day and averages $50 a trade before it has to pay the fees.

If you’re considering a trading system between System A and B, you’ll most likely choose System B over System A. However, when commissions and slippage are included, the former is actually the better option. It trades less and pays less commissions.

“It is critical, then, to include adequate amounts for commissions and slippage at the start of development.”

#3. All data used

Another mistake that many traders make is the use of all of the historical data for their analysis. Most novice traders will often run multiple tests and analysis until the day before the market opens. The goal of this strategy is to make sure that the system is still tuned to the most recent data.

The better way is to test a trading system by verifying it on un-sampled data. For instance, a trader might develop a strategy for several years but leave the data that’s been collected in the past year untouched. After the development of the strategy is complete, the system is tested on unseen data. If the system performs well on the un-sampled data, it can be considered for live trading.

Three human-dependant mistakes in algorithmic trading

The advantages of algorithmic trading are obvious: faster execution and more efficient research. They also help minimize the market impact of big trades by making it easier for them to split orders. However, some believe that the human element still rules in a world of algorithmic trading.

There are still a lot of mistakes that purely come from a human mind and can be harmful to algo trading profits.

#1. Having zero coding knowledge

One of the most important factors that a novice should consider before starting a trading system is learning how to code. This will allow them to develop a strategy that’s close to mathematical formulas. It’s also important to understand the various components of the system that are under the hood. Having the necessary knowledge to understand everything that’s happening in the market will allow you to improve your trading process.

Learning how to code is not a quick process, and it’s important to take the time to understand the process. There are several free resources online that can help you learn about trading development. One of these is the MQL5.community, which is a community for traders and developers.

#2. Not taking your trading job seriously

Not treating trading occupation as a real business is another common mistake. For instance, tell someone about how you used to own a big business, yet you have no record of how many sales you made, how many items you sold, and how long it took most customers to trickle in. Nobody will believe you, right?

Trading record keeping includes all the details of your trading activities, such as how much leverage you have, your positions, and the types of securities that you’re holding. Having these records will allow you to analyze and improve your trading skills. Besides being able to keep track of all of your trading activities, having records also allows you to identify areas of weakness and strengths.

#3. Interrupting your algo robot

One of the main reasons why people trade is because they want to remove human input from their trading process. In the event that a large drawdown occurs, you might feel an urge to intervene. However, this is not the case, as your strategy is more important than any arbitrary decision-making.

It is however imperative that a trader regularly monitors the performance of their strategy in order to find out the reason behind the decline in returns.