To sign up for our daily email newsletter, CLICK HERE

Given the global spread of COVID-19, more time at home, not surprisingly, has resulted in a rapid acceleration of content streaming over the past year. People have become increasingly dependent on streaming services to provide entertainment, resulting in a surge in both usage and subscriptions. For the advertising-based video on demand (AVOD) platform, this was particularly beneficial.

Of course, the rise, and the relevance of content streaming is nothing unusual. TV. Market research company eMarketer projects streaming use to outpace cable subscription households by 2023, when access to an estimated 64.4 million households is projected to exclusively default to streamers.

The end result: Streaming usage in OTT-capable households had already nearly doubled in less than two years prior to the coronavirus pandemic. Now, as this digital transformation continues to increase, there are more options for advertisers to access incremental TV audiences.

“The streaming market benefitted because it is one of the few things we were prepared for in a locked-down, theater-free world, sitting in our living rooms with the best-ever internet bandwidth delivering 4K, Dolby content on everything from our mobile devices to our 40”+ televisions,” noted Mike Tankel, partner/optimist at marketing and development firm To Be Continued. “Streaming is not going away. If we weren’t streaming prior to the pandemic, we certainly are now. What has happened was an acceleration of the inevitable evolution of entertainment. We will have in-theater movies, streaming movies, user-generated content, and most anything else for years to come.”

More Value Per Impression Via Streaming

For the typical consumer, the most powerful advantage of streaming is the consumption of content on your own time; when you want and where you want. You create your own schedule. You don’t need to program your DVR; the whole season of a typical TV series is commonly available any time of day after episodes are released. And the rise of available streaming services has resulted in an abundance of content available at your fingertips.

For an advertiser, this strategy gives brands the opportunity to reach highly engaged viewers on a targeted, impression basis rather than the mass-audience coverage. While Netflix, the leader of the streaming market, is ad-free, as are many of its competitors, there are a number of ad-supported media providers that have also been rapidly growing. AVOD, in particular, has experienced a noticeable surge.

“The majority of streamers are incremental to who brands are reaching through their existing linear TV strategy, and even incremental to other AVOD platforms,” said Melinda Staros, Director of Audience Research at Tubi, who spearheaded the service’s report, “The Stream: 2021 Actionable Audience Insights for Brands.” “So, advertisers are reaching an audience they can’t reach anywhere else that is engaged, that is spending a lot of time consuming content, and has the potential to be micro-targeted. For these advertisers, streaming offers a lot more value per impression.”

“The brand lift, the offline conversions, and the increased reach are the key KPIs (key performance indicator) for advertisers,” she added. “Streaming has been around forever, but it hasn’t been around for advertisers to take advantage of until recently. That is because of the rapid growth in the AVOD space and the unlocked opportunity to reach this audience with advertising. The convergence of these two are paving the way to the shift for TV strategies in 2021, and how media planners should be thinking about buying the streaming audience going forward.”

Tubi

Launched in 2014, Tubi (Tubitv.com) is a free ad-supported streaming service now owned by Fox Corporation, with a library of content for both film and television from over 250 content providers across most major Hollywood studios.

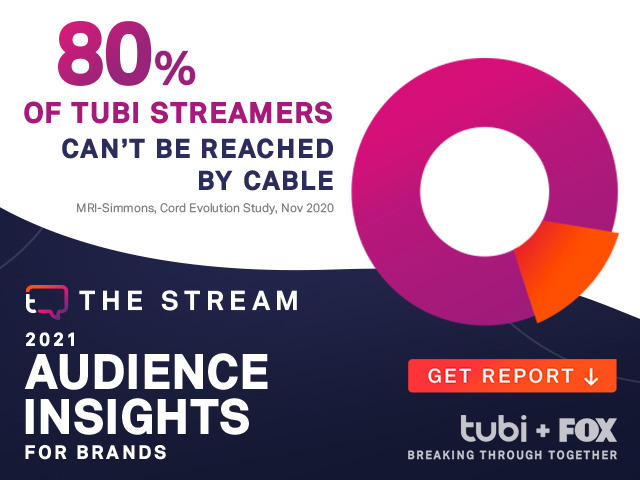

In 2020, the company saw its Monthly Active Users grow to 33 million viewers and Total View Time skyrocket to an estimated 2.5 billion hours streamed for the year. Similar to general OTT trends, there is a reported increase of 58 percent in viewership for Tubi over the past 12 months. Growth in streaming hours has almost doubled since 2019. And almost half of the Tubi streamers, particularly in the 18-34 demographic, are cable free.

Additionally…

-Tubi streamers, on average, are 20+ years younger than the average linear TV audience.

-Almost half (48 percent) of Tubi streamers (and 57 percent in the 18-34 demo group) are cable free.

-Four out of five (84 percent) Tubi streamers watch Tubi on their TV,

-Eighty-five percent of Tubi streamers live in households of two or more people.

Streaming Reaches a Younger, More Diverse Audience

As a case point, competition series “The Masked Singer” expanded its reach from the typically older-skewing audience via the linear Fox platform to a younger streaming audience – the best of both worlds, perhaps – when it began streaming on Tubi. The average audience for “The Masked Singer” on Tubi was 16 years younger than the audience profile on linear.

“Being nationally representative of streaming means skewing younger,” noted Staros. “Almost 50 percent of our audience is under the age of 35, and there is quite a big difference in the average age of the audience between streaming and linear TV. That speaks to the synergy between the two. When you are able to leverage streaming alongside linear as part of your media strategy, you’re able to reach net-new audiences.”

Traditional TV Ad Budgets Remain Consistent

Even as the pattern of fewer viewers consuming content on a linear platform continues in favor of more streaming, the linear model continues to dominate (by as much as 90 percent of a video ad spend). Part of that reason is the newness of streaming; many agencies and marketers remain unclear about how audience-based streaming advertising works. More specifically, they would invest more in streaming if they could better manage ad frequency. And others have suggested they would invest more in OTT ad buys if they had greater transparency into where and how their ads would run.

Looking ahead, two out of five marketers, according to the “The Stream: 2021 Actionable Audience Insights for Brands” report by Tubi, said they would invest more dollars in streaming if they could better manage ad frequency.

Tubi, in response, introduced its Advanced Frequency Management solution (AFM) in 2020, which by transcoding every ad that comes in (identifying if duplicates exist) gives advertisers full control over their ad frequency across all demand sources. That enables advertisers to cap ad frequency at the campaign level as they see fit.

Advertisers, meanwhile, who have invested in streaming rate it as more effective than both linear and digital video. One in five advertisers are expected to devote a quarter of their entire video budget to streaming TV in 2021. And, over the next six months, 66 percent of all advertisers are expected to increase their streaming ad budgets.

“The biggest change in streaming over the past year has really been the behavioral shift, understanding that streaming services and providers are now the dominant way people watch TV and content,” noted Staros. “Even though the pandemic has helped boost – or bump – this streaming space, the trend has been coming for a long time. People were in a particular mindset of making behavioral changes during the pandemic and this was the time to try new things while quarantining at home. Having now discovered free streaming as an avenue just speeds up the inevitable.”