To sign up for our daily email newsletter, CLICK HERE

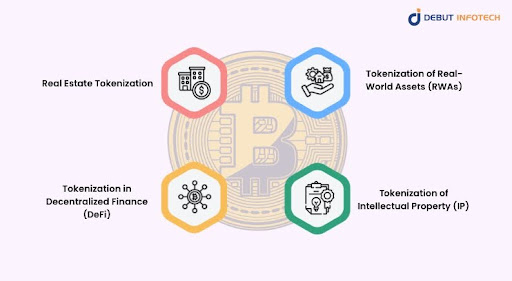

Emerging as one of the most fascinating developments in recent years, tokenization opens new opportunities for fractional ownership and more liquid markets. It turns real-world assets ( RWAs) into digital tokens sold safely on blockchain systems (real-world asset tokenization). This breakthrough technology might completely transform many sectors, from real estate to finance and beyond. Tokenizing helps investors access previously out-of-reach assets, fostering increased inclusion and financial equality. Blockchain technology also improves efficiency and transparency by offering a tamper-proof, safe setting for transactions.

Tokenization trends are causing a fundamental shift in how assets are traded and maintained. As investors search for more varied options, tokenization—once limited to conventional financial markets—is gaining headway in real estate, luxury products, and even commodities. As businesses embrace this transforming technology, the worldwide tokenization market is projected to expand quickly.

We will investigate the main tokenization trends influencing the industry, go over important use cases across sectors, and underline the most exciting tokenized assets to keep an eye on in the not-too-distant future on this blog.

Emerging Tokenization Trends to Watch in 2024

Tokenization is changing quickly; 2024 has offered numerous important trends that will transform asset digitalization and trading. Some of the main tokenization trends are explored below.

Real Estate Tokenization

Real estate tokenization is among the most common applications for tokenization trends; it has greatly reduced investor entrance requirements. Because of their high financial needs and lengthy transaction timeframes, real estate transactions have historically been limited to wealthy people and big institutions. Tokenization, on the other hand, lets assets be divided into smaller pieces so that smaller investors may buy real estate.

Driven by innovative blockchain technology, real estate tokenization systems provide a smooth approach to tokenizing valuable properties, opening a larger pool of investors to access them. These sites also enable cross-border investments, letting foreign investors own pieces of real estate without negotiating the sometimes convoluted financial and legal systems connected with conventional real estate.

Real estate blockchain businesses have been developing cutting-edge solutions to guarantee the safe tokenizing and trading of assets, thereby establishing a safer and more open investing environment. Specific tokenizing systems also include smart contracts, which streamline many operations—from the ownership transfer to the distribution of rental income or dividends—so optimizing the whole process.

Expanding into Commercial and Luxury Real Estate

Although residential real estate is still the most often used asset class for tokenization trends, luxury, and commercial properties are increasingly being tokenized. Because of its strong rental returns and possibility for long-term gain, commercial real estate—including office buildings, retail malls, and industrial warehouses—offers an appealing investment possibility. Real estate tokenization platforms are progressively focusing more on these assets by providing fractional ownership choices to investors who might not have the money to buy whole buildings.

Luxury real estate, including vacation houses and upscale mansions, is also becoming tokenized to allow investors to hold a piece in top-notch assets. Real estate blockchain companies are allowing investors to diversify their portfolios with highly valuable assets once beyond reach by tokenizing luxury homes.

Tokenization of Real-World Assets (RWAs)

Real world assets ( RWAs) are items traded as top trending tokens on blockchain systems after being digitized. As more sectors explore the advantages of tokenization, such as commodities, art, and even intellectual property, this trend is advancing.

Valuables and Precious Metals

Retail investors can now more easily access valuable commodities, including gold, oil, and natural gas since they can be easily tokenized. Though institutional players dominated goods markets historically, tokenizing access to these markets has opened up access to them. For example, tokenized gold allows investors to purchase tiny pieces of precious metal, which may be traded on blockchain networks with more liquidity than on regular physical markets.

Gold and silver have historically been considered sources of security. Tokenization is making these valuable metals more appealing to investors who might not want to own the asset but want to make money off its worth. Tokenization platforms for precious metals have fractional ownership, streamlining these metals’ purchasing, selling, and trading.

Tokenized Art and Collectibles

The tokenization trend is also having an impact on the art world. Tokenized art lets collectors own some precious artwork that may be traded on blockchain systems. Investors who desire exposure to the fascinating art market but cannot buy complete paintings will find this trend extremely appealing.

Tokenizing valuables, including expensive watches, vintage vehicles, and rare wines, also gives investors a fresh approach to varying their holdings. The spectrum of tokenized assets will grow as tokenization platforms develop, allowing one to invest in everything from rare antiques to great art easily.

Tokenization in Decentralized Finance (DeFi)

The Decentralized Finance (DeFi) industry is likewise being significantly transformed by tokenization. Tokenized assets can be leveraged in yield farming techniques, sold on decentralized exchanges, and used as collateral for loans in the decentralized finance technology (DeFi) system. The spectrum of tokenized assets accessible in the ecosystem will widen as DeFi protocols become more complex.

Tokenized real estate, for instance, can be included in DeFi systems to create fresh financial products, including loans that are supported by it. This can create new opportunities for investors wishing to generate passive income from their tokenized assets. As more real world assets are uploaded onto blockchain systems, the synergy between tokenization and DeFi is predicted to be a main trend in the next few years.

Tokenization of Intellectual Property (IP)

In the intellectual property (IP) field, tokenization is a trend that is also causing a stir. Tokenizing copyrights, trademarks, and patents helps to generate partial ownership, thereby enabling artists and inventors to use their intellectual property (IP) more profitably. Blockchain platforms allow one to exchange tokenized intellectual property (IP), offering a fresh innovation funding source.

This trend especially seems optimistic for sectors like medicines and technology that depend on significant R&D. Companies can unlock the value of their discoveries and bring new goods to market more quickly when they tokenize their intellectual property (IP).

Security Token Offerings (STOs) and Initial Exchange Offerings (IEOs)

Initial Exchange Offerings (IEOs) and Security Token Offerings (STOs) are examples of fundraising strategies becoming increasingly prevalent in the tokenization ecosystem. On a blockchain, STOs entail releasing tokens on a blockchain that symbolize conventional securities, such as bonds or stocks. Conversely, IEOs entail token sales via a cryptocurrency exchange.

Both approaches let investors buy tokens reflecting fractional ownership in an asset or company. Though STOs and IEOs offer a safer and more regulated alternative, many have expressed worries regarding the lack of control around initial coin offers (ICOs).

Particularly in controlled industries like real estate and finance, STOs, and IEOs are expected to grow even more critical in the tokenization of assets as the market matures.

Regulatory Advancements in Tokenization

Tokenizing is growing in direct line with changes in regulations. Governments and financial regulators strive to create clear rules to guarantee that as more assets get tokenized, they may be traded legally and safely. This is particularly crucial in industries like real estate, where ownership and transfers of tokenized assets need to abide by current rules and laws.

Switzerland, Singapore, and the United States are leading nations that have established pro-blockchain rules that support invention while safeguarding investors. More institutional investors, who want more regulatory clarity before putting money into the market, are likely to embrace tokenization due to these developments.

How Debut Infotech Can Help with Tokenization

Our specialty at Debut Infotech provides complete tokenizing solutions for many different sectors. Our thorough knowledge of blockchain technology helps us create tokenization platforms that follow strict regulatory criteria and are scalable and safe. Whether your project calls for tokenizing intellectual property, real estate, or other real world assets tokenization, our team of professionals has the knowledge and tools to guarantee success.

Working closely with companies, we find their specific goals and customize tokenizing solutions to enable them to uncover fresh value in their assets. From conceptualization and platform development to guaranteeing adherence to relevant laws, our services cover the whole lifetime of a tokenization project. We design systems that allow flawless asset tokenizing to fit every customer’s requirements.

Among our services are real estate tokenization platforms, consulting on negotiating the legal environment for tokenization projects, and custom-built tokenization platforms for other asset kinds. We also concentrate on extending the use and liquidity of tokenized assets by combining them with distributed finance (DeFi) systems.

Your company can fully utilize tokenization by collaborating with Debut Infotech, opening up new growth opportunities and cutting-edge financial models. Working together, we enable companies to maximize their asset value and stimulate innovation across sectors by using the most recent developments in tokenization.

Conclusion

Tokenization is going to transform our trading and investment behavior with regard to real-world assets. Tokenization opens new possibilities and makes once-illiquid markets more accessible and efficient, from real estate to intellectual property. The spectrum of tokenized assets will keep expanding as new tokenization platforms develop and legal structures change, providing companies and investors with fascinating and new possibilities.

Businesses can put themselves at the forefront of this game-changing technology and take advantage of its potential by keeping up with the most recent tokenization developments and collaborating with seasoned tokenization platforms like Debut Infotech.