To sign up for our daily email newsletter, CLICK HERE

Overview

Banking isn’t what it used to be. Most of us need fast, efficient, flawless banking services that are hassle-free and, most importantly, reliable. It only makes sense to shift to digital banking channels that can provide these things. As it turns out, artificial intelligence (AI) and machine learning (ML) powered virtual assistants can do precisely that.

Are virtual assistants in banking the solution to outdated, cumbersome branches and lengthy wait times? More and more banks are turning to chatbots and virtual assistants for customer service.

Artificial intelligence is becoming more ingrained in day-to-day life. A recent Ipsos-Forbes Advisor survey found that an overwhelming majority of Americans – 76% – used their bank’s mobile app to conduct everyday banking tasks last year

This blog will look at how a virtual assistant can help you with your banking and how banks are turning to chatbots.

How Virtual Assistants Shape The Banking Industry?

1. Everyday Inquiries

A banking software development services provide a virtual assistant can help you with everyday inquiries. Since they are available 24/7, they can assist you when an issue arises after-hours or even on weekends.

With the right training data, bank virtual assistants can be taught to answer customer queries quickly and precisely, providing faster resolutions.

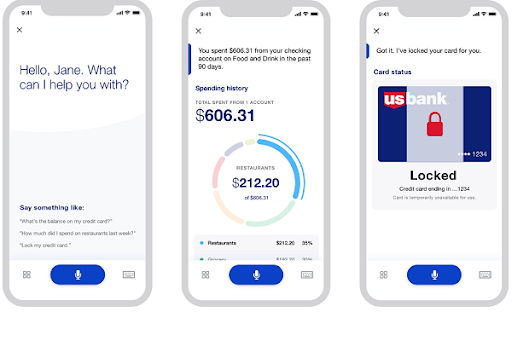

For example: For example, one bank’s virtual assistant service helps customers find out if their account needs attention by answering questions like “How much money did I spend last week?” Or, “What have my recent purchases been?”

Virtual assistants can make banking easier by handling:

- Inquiries about account balances, deposits, withdrawals, and transfers;

- Inquiry about account details (such as interest rates);

- Inquiry about applying for loans;

- Inquiry about transferring funds between accounts; and

- Inquiry about bill payments.2.

2. Save Time on Typing

Typing is one of the most time-consuming parts of any job—especially when it comes to banking. A voice assistant can help you get everything out of the system quickly by typing all of your documents for you.

You can fill out forms or enter information without the use of text feature with a simple conversational AI command or tap-and-go gesture. That means less time spent on repetitive tasks.

For example, the Bank of America mobile app has Erica, a virtual assistant, as part of its digital banking experience. It helps customers save time with activated voice commands by automatically performing repetitive tasks such as entering account numbers or routing numbers into forms. The goal is for Erica to make customers’ lives easier by removing tedious and manual tasks from their day.

3. Make Simple Transactions

Banking VAs are great at processing simple transactions for you. You can easily ask them to transfer money between accounts or pay bills on autopilot.

VAs will send you reminders when you need to make a payment and handle all the details for you, so all you have to do is confirm the transaction and wait for it to complete.

Here are some examples of simple transactions:

- Pay your bills.

- Transfer funds between accounts.

- Check your balance.

- Make a deposit or withdrawal.

4. Notifications about Unusual Activity

Your bank should monitor your accounts for unusual activity to alert you if anything looks suspicious or out of place.

However, these alerts can often be buried deep within lengthy emails or notifications that don’t always reach their intended recipients in time to take action before any damage is done.

Banking virtual assistants can help you keep track of your accounts and detect suspicious activity before it becomes serious enough for you to notice on your own.

For example, if someone tries to make an unauthorized withdrawal from your account, you’ll want to know immediately to take action before any damage is done. Capital One’s virtual assistant, Eno, can keep track of all of this activity for you and let you know if anything seems out of place or suspicious.

5. Get Advanced Insights

Banking VAs can help you find the best bank account by providing advanced insights into your banking and financial situation.

You’ll get an idea of how much money you spend on certain types of transactions and what rewards program would work best for your lifestyle.

Here are some examples of advanced insights that Bank of America’s VA, Erica, can provide:

- Track your monthly income and expenses

- Changes in your FICO score

- How much money do you spend on groceries, dining out, or other common monthly purchases?

- Recurring spending trends

- Your account balance trends

Conclusion

As a result of technological growth, financial institutions seem capable of striking the right balance between making banking more convenient and increasing customer loyalty by providing virtual assistants.

As is often the case with new technology, this is still in its early stages. If you research and vet your options properly, you can get an effective assistant to improve your banking experience.

Author Bio

Vatsal Ghiya is a serial entrepreneur with more than 20 years of experience in healthcare AI software and services. He is the CEO and co-founder of Shaip.com, which enables the on-demand scaling of our platform, processes, and people for companies with the most demanding machine learning and artificial intelligence initiatives.

Linkedin: https://www.linkedin.com/in/vatsal-ghiya-4191855/