To sign up for our daily email newsletter, CLICK HERE

During the early days of investing, it was a highly human affair. Dealers would entertain fund managers and investors, and nobody knew what the prices were. Ray Dalio, who founded the world’s largest hedge fund, says that during his time working on the New York Stock Exchange.

As written by The Entrepreneur, in the 1980s, when Kenneth Jacobs was a senior executive at Lazard, a financial firm, he used a pocket calculator to analyze company reports. His older colleagues also used slide rules. Today, the role of humans in trading has diminished significantly. Instead of trying to beat the market, they are now being replaced by computers and passive managers.

In 2021, the global algorithmic trading market had a value of US$13.0 billion. According to IMARC Group, the market is expected to reach a value of US$24.0 billion by 2027.

Mass Adoption

The main factor driving the growth of the algorithmic trading market is the increasing number of small and medium-sized enterprises adopting technology to improve their efficiency and generate profit. In addition, the rising need for fast and reliable order execution also contributes to the market’s growth.

Algorithmic trading systems are used by large brokerage firms and institutional investors to cut down on their costs. It can also be used in various situations, such as the execution of orders and strategies. It has the advantage of being able to perform faster than human traders.

The government’s support for the development of regulations and the increasing demand for surveillance are also contributing to the growth of the algorithmic trading market. In addition, technological advancements such as the integration of AI, stock research websites and cloud computing are expected to create a positive outlook for the market.

More and Better Strategies

According to a study conducted by Jupiter Asset Management, in 2018, over 80% of the stock market transactions in the US were conducted by machines. This means that investors and traders no longer have the ability to trade with small spreads and high speed.

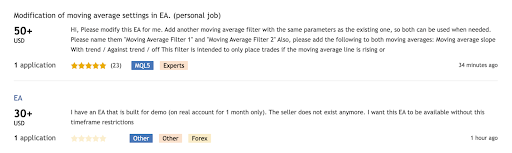

There are many types of algorithms and strategies that are used in the trading of stocks. Some are designed to automate the execution of transactions, while others are built to provide a more accurate and efficient view of the market. The industry of algorithmic trading has created a new source of income for both the end-users and the developers. One of the most popular platforms that developers use is MQL5.Community. This platform has a community of buyers and developers who are ready to implement a strategy in a trading robot (aka Expert Advisor).

Task examples from the Freelance portal | MQL5.Сommunity — credit: MQL5.com

High Frequency

High-frequency trading is a type of financial transaction that aims to minimize risk and provide fast and efficient trading. It involves posting small deal sizes that allow users to move in and out of trades quickly. There are various forms of HFT.

High-frequency traders are those who make markets by providing both buy and sell orders on a variety of different securities. They are known as market makers and are typically referred to as traders who utilize algorithms to try to predict the direction of the markets. Regardless of their strategy, these individuals all try to do the same thing: make vast profits by being more efficient and faster than everyone else.

Backtesting Ability

The newly generated algorithms are tested using historical data. This allows the trader to determine if the strategy will work or not. The results of the test can then be used to fine-tune the strategy.

One of the most common ways to evaluate the performance of a financial trading strategy is by testing its historical data. This method uses a simulation to replay the past performance of a strategy or strategy.

Experienced traders from MQL5.Community shares the knowledge and tips on proper backtesting and technical checks of trading robots.

Conclusion

Over the past decade, the way securities are traded has dramatically changed. Due to the technological advancements that have occurred in the capital markets, wall street traders now make trades in just a few microseconds. We have considered a few biggest reasons for machines taking over the trades, but still, human intervention is an integral part of trading, and the wolves of wall street are now just a bit another people — those who can create a profitable trading strategy and then realize its implementation via a trading robot.

“Despite the economic recession, high-frequency trading has been considered by many to be the biggest “cash cow” on Wall Street and it is estimated that it generates approximately $15- $25 billion in revenue.” — Michael J. McGowan, “The Rise of Computerized Hig Frequency Trading: Use And Controversy”